Understanding the Sales Trends in NSDCC: A Closer Look

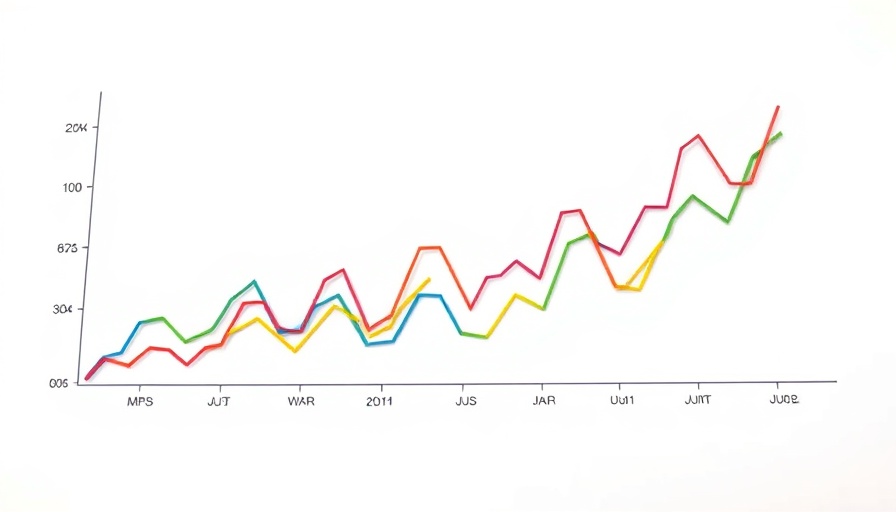

The real estate market is always subject to fluctuations, and the North San Diego County Coastal (NSDCC) area is currently experiencing an interesting dynamic. While some experts are pointing to declining sales figures, it’s essential to dig deeper into the implications behind these numbers. As reported by Jim Klinge, pricing remains steady, indicating a potentially durable market structure amid shifting buyer dynamics.

What Decreased Sales Volume Means for Buyers and Sellers

Fewer sales often suggest a more patient seller market. When sellers choose not to drop their asking prices dramatically, it signals confidence in the value of their properties. This patience could mean that sellers are preparing for a longer wait for the right buyer rather than forcing deals through price cuts. For buyers, this could translate to fewer options available—encouraging a more strategic approach in their purchasing offers.

The Potential for Record Unsold Properties

Predicting the future state of the market can be challenging. Klinge hints at the possibility of achieving the highest number of unsold properties by year-end. If sales numbers do not pick up, this might reflect a market correction framework, prompting ongoing discussions among market analysts. Buyers might find themselves waiting for the right moment, while sellers must continue to balance pricing with market demands.

Current Market Dynamics: Economic Indicators

Understanding the current economic landscape is crucial for making informed decisions. With rising mortgage rates influencing buyer sentiment and increasing costs for homeownership, it's imperative to remain alert to economic trends. The interplay between interest rates and property values could redefine strategies for both buyers and sellers in the NSDCC area.

Future Predictions: Will Prices Hold Steady?

The real question remains: will prices hold firm as we enter a possible recessionary period? The consensus among some analysts suggests that while demand might fluctuate, the inherent value of coastal properties in NSDCC lends it some resilience. Prospective buyers may need to prepare for potentially less favorable buying conditions—this could mean tightening budgets or preparing to compromise on features.

Insights from Local Experts

Local knowledge and expertise can provide unique insights into these trends. Areas around NSDCC have specialized market dynamics influenced by community developments, amenities, and lifestyle offerings. Engaging with local realtors and experts can help buyers and sellers understand longer-term implications and strategies for navigating the current climate effectively.

Practical Tips for Buyers and Sellers in This Market

In a more nuanced market, both buyers and sellers must be proactive:

- For Buyers: Focus on long-term value rather than rushed decisions. Evaluate neighborhoods and overall market stability.

- For Sellers: Maintain transparency in property valuation and be open to negotiation without drastic pricing reductions.

Conclusion: The Importance of Staying Informed

Understanding shifting market conditions is vital for all participants in the real estate field. Whether you're an auto repair business owner looking to expand your investments or simply a resident contemplating a new home purchase, staying informed will enhance your decision-making ability. Now is the time to assess your position and prepare for potential opportunities as the market evolves.

Call to Action: If you're considering making a move in the real estate market, or you simply want to learn more about your local area’s options, don't hesitate to reach out. Our team at Klinge Realty is here to assist you in navigating this complex landscape. Contact us at (858) 997-3801 or email klingerealty@gmail.com for personalized assistance.

Add Row

Add Row  Add

Add

Write A Comment